Are you tired of navigating the complexities of healthcare expenses? Look no further than a Health Savings Account (HSA) to simplify your financial planning. In this informative article, we will explore the benefits of opening an HSA, the eligibility requirements, and the step-by-step process to establish your account. Additionally, we will delve into contribution limits, investment options, and the tax advantages of having an HSA. Maximize the benefits of your healthcare savings with our expert tips.

Key Takeaways

- Opening a Health Savings Account (HSA) allows individuals to save money on healthcare expenses and have more flexibility in managing their healthcare budget.

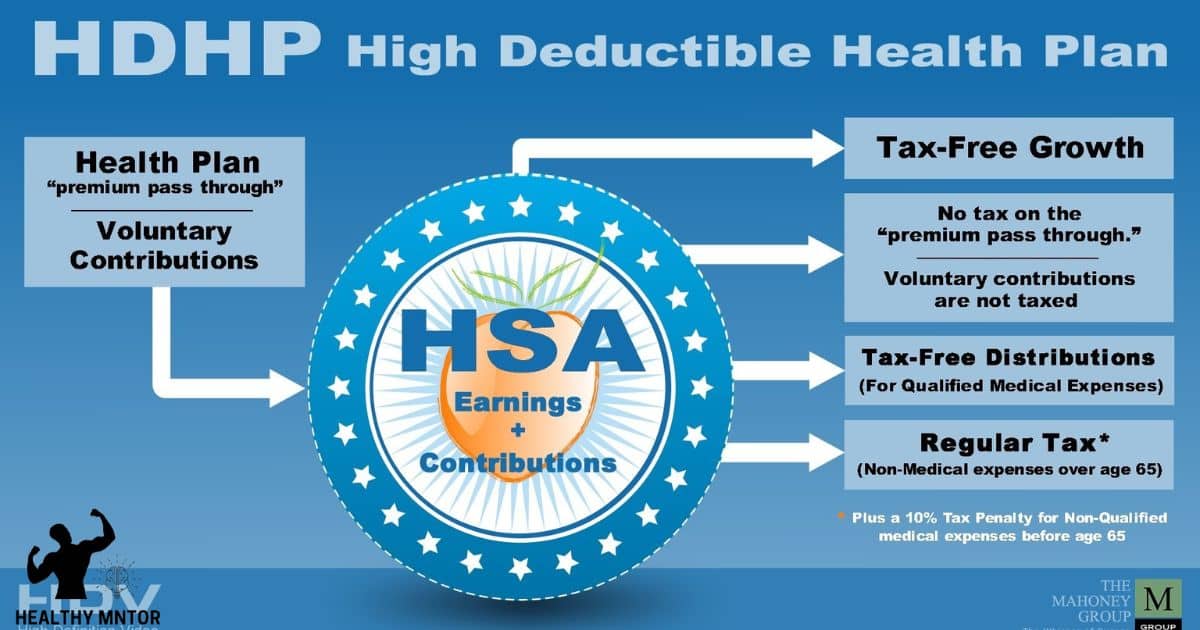

- To be eligible for an HSA, individuals must have a valid High Deductible Health Plan (HDHP) that meets the minimum deductible set by the IRS, and they must not have any other health coverage that disqualifies them from having an HSA.

- HSA offers tax advantages, including tax-deductible contributions, tax-free interest or investment gains, and tax-free withdrawals for qualified medical expenses.

- Individuals can choose from various investment options for their HSA funds, such as stocks, bonds, mutual funds, or ETFs, but it’s important to assess the potential risk and return of each option and consider individual risk tolerance and investment goals.

Benefits of Opening a Health Savings Account

One of the benefits of opening a health savings account is that it allows individuals to save money on healthcare expenses by contributing pre-tax dollars. This means that the money you put into your HSA is not subject to income tax, maximizing your savings potential. By taking advantage of this tax advantage, you can stretch your healthcare dollars further and have more flexibility in managing your healthcare expenses. With an HSA, you can use the funds to pay for a wide range of medical expenses, including doctor visits, prescription medications, and even certain over-the-counter items. This flexibility allows you to tailor your healthcare spending to your specific needs, giving you greater control over your healthcare budget. Transitioning into the next section, it is important to understand the eligibility requirements for opening an HSA.

Eligibility Requirements for Opening an HSA

To be eligible for opening an HSA, individuals must meet certain requirements and adhere to specific regulations. Here are the key eligibility criteria and steps involved in the opening process:

- High Deductible Health Plan (HDHP): To qualify for an HSA, you must have a valid HDHP. This type of health insurance plan typically has a higher deductible and lower premiums compared to traditional plans.

- Minimum Deductible: The HDHP must meet the minimum deductible set by the Internal Revenue Service (IRS). For 2021, the minimum deductible for an individual is $1,400, and for a family, it is $2,800.

- Maximum Contribution Limits: There are annual limits on the amount you can contribute to your HSA. For 2021, the maximum contribution is $3,600 for individuals and $7,200 for families.

- Non-Disqualifying Coverage: You must not have any other health coverage that disqualifies you from having an HSA, such as being enrolled in Medicare or being claimed as a dependent on someone else’s tax return.

Understanding the eligibility criteria and following the opening process will help individuals determine if they qualify for opening an HSA and take advantage of its benefits.

Steps to Open a Health Savings Account

To open a Health Savings Account (HSA), you must first meet the eligibility requirements and gather the necessary documents, such as proof of insurance coverage and a completed HSA application form. Once you have gathered all the required information, you can contact a financial institution or an HSA provider to set up your account. Opening an HSA can provide various benefits, including potential tax advantages and the ability to save for future healthcare expenses.

Eligibility Requirements and Process

A potential account holder must meet certain eligibility requirements and complete the necessary steps to open a Health Savings Account (HSA). Here are four important factors to consider when opening an HSA:

- Eligibility: To open an HSA, you must have a high-deductible health plan (HDHP) and cannot be enrolled in Medicare. Additionally, you cannot be claimed as a dependent on someone else’s tax return.

- Contribution Limits: There are annual limits on how much you can contribute to an HSA. For 2021, the contribution limit for individuals is $3,600, and for families, it is $7,200. These limits are subject to change each year.

- Tax Advantages: Contributions to an HSA are tax-deductible, and any interest or investment gains within the account are tax-free. Withdrawals for qualified medical expenses are also tax-free.

- Investment Options: Once you have a certain balance in your HSA, you may have the option to invest the funds in mutual funds, stocks, or other investment vehicles. This can potentially grow your savings over time.

Opening an HSA can provide individuals with a tax-advantaged way to save for medical expenses. By understanding the eligibility requirements and available options, individuals can make informed decisions about their healthcare savings.

Benefits and Tax Advantages

There are several benefits and tax advantages associated with opening a Health Savings Account (HSA), including tax-deductible contributions and tax-free withdrawals for qualified medical expenses. An HSA allows individuals to set aside funds specifically for healthcare expenses, providing a way to save for future medical needs while maximizing tax benefits. Contributions made to an HSA are tax-deductible, reducing the individual’s taxable income for the year. Additionally, any interest or investment gains earned on the HSA funds are tax-free. When funds are withdrawn for qualified medical expenses, they are also tax-free. This combination of tax advantages and savings potential makes HSAs an attractive option for individuals looking to manage their healthcare expenses effectively. By opening an HSA, individuals can take advantage of the tax benefits while building a financial cushion for their healthcare needs.

Understanding the Contribution Limits of an HSA

Frequently, individuals seeking to maximize their health savings account (HSA) contributions must first gain a comprehensive understanding of the contribution limits set by the Internal Revenue Service (IRS). Here are four key points to consider when it comes to contribution limits and maximizing savings:

- Annual Limits: The IRS sets annual contribution limits for HSAs, which are subject to change. For 2021, the limits are $3,600 for individuals and $7,200 for families.

- Catch-up Contributions: Individuals aged 55 and older can make additional catch-up contributions to their HSAs. The catch-up contribution limit for 2021 is $1,000.

- Employer Contributions: Employers can also contribute to their employees’ HSAs, which can help individuals reach the maximum contribution limit more quickly.

- Tax Deductibility: Contributions made to an HSA are tax-deductible, meaning individuals can reduce their taxable income by the amount contributed.

Understanding these contribution limits is crucial for maximizing savings in an HSA. Additionally, it’s important to consider the role of a durable power of attorney for health care when managing your healthcare decisions and finances. Now, let’s explore the investment options for your HSA funds.

Investment Options for Your HSA Funds

When considering investment options for your HSA funds, it is important to assess the potential risk and return of each option. This will help you make informed decisions and maximize the growth of your funds. There are various investment strategies you can consider, such as investing in stocks, bonds, mutual funds, or exchange-traded funds (ETFs). Each option comes with its own level of risk and potential return. It is crucial to carefully evaluate your risk tolerance and investment goals before making any decisions. Additionally, it is important to be aware of any HSA account fees associated with these investment options. These fees can impact your overall returns, so it is essential to factor them into your decision-making process. Below is a table summarizing the potential risk and return of different investment options for your HSA funds:

| Investment Option | Potential Risk | Potential Return |

|---|---|---|

| Stocks | High | High |

| Bonds | Medium | Medium |

| Mutual Funds | Medium to High | Medium to High |

| ETFs | Medium to High | Medium to High |

Remember to consult with a financial advisor for personalized advice based on your individual circumstances.

Tax Benefits of Having a Health Savings Account

One significant benefit of having a health savings account is the potential tax advantages, including the ability to contribute pre-tax dollars and enjoy tax-free withdrawals for qualified medical expenses. Here are four tax benefits of having an HSA:

- Pre-tax contributions: Contributions made to your HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute.

- Tax-free growth: Any interest or investment gains earned within your HSA are not subject to federal income tax, allowing your funds to grow faster over time.

- Tax-free withdrawals: When you use your HSA funds for qualified medical expenses, the withdrawals are tax-free, providing you with additional savings.

- Triple tax advantage: HSA contributions, growth, and withdrawals are all tax-free, making it a powerful tool for saving money on healthcare expenses.

Tips for Maximizing the Benefits of Your HSA

To fully maximize the benefits of your Health Savings Account (HSA), it is important to regularly review your contributions and expenses, and also consider exploring investment options. By doing so, you can ensure that you are effectively using your HSA funds and maximizing your savings potential.

Regularly reviewing your contributions and expenses allows you to assess whether you are contributing enough to your HSA and if you are utilizing your funds wisely. It is important to strike a balance between saving for future healthcare expenses and using your funds for current medical needs.

Additionally, exploring investment options can help you grow your HSA funds over time. Many HSA providers offer investment options such as mutual funds or stocks, which can potentially generate higher returns compared to leaving your funds in a regular savings account.

Frequently Asked Questions

Can I Use My Health Savings Account Funds to Pay for Non-Medical Expenses?

Using health savings account funds for non-medical expenses, such as cosmetic procedures, may have tax implications. It is important to understand the rules and regulations surrounding the use of HSA funds to avoid any potential penalties or tax liabilities.

Can I Contribute to My Health Savings Account if I Already Have a Different Type of Health Insurance?

Yes, you can contribute to your Health Savings Account (HSA) even if you have a different type of health insurance. However, it’s important to be aware of the contribution limits and tax implications.

Can I Withdraw Money From My HSA Without Penalty if I Use It for Non-Qualified Medical Expenses?

Withdrawal penalties and HSA tax implications are important considerations when using funds for non-qualified medical expenses. Understanding the rules and regulations surrounding these withdrawals is crucial to avoid any potential penalties or tax consequences.

Can I Transfer Funds From My Existing Health Savings Account to a New Hsa?

Transferring funds from an existing Health Savings Account (HSA) to a new HSA is possible, subject to certain eligibility requirements. It is crucial to understand the guidelines and restrictions regarding eligible expenses to ensure compliance.

Can I Have More Than One Health Savings Account at a Time?

Having multiple Health Savings Accounts (HSAs) can provide several benefits. It allows individuals to allocate funds for different healthcare needs, maximize tax advantages, and have flexibility in managing healthcare expenses.

Conclusion

In conclusion, opening a health savings account (HSA) can provide individuals with numerous benefits, such as tax advantages and investment options. However, eligibility requirements must be met, and there are specific steps to follow when opening an HSA. Understanding the contribution limits and maximizing the benefits of an HSA can greatly enhance its effectiveness. One interesting statistic is that according to the Employee Benefit Research Institute, the number of HSA accounts reached 30.2 million in 2020, highlighting the growing popularity and importance of these accounts in managing healthcare expenses.