In the intricate tapestry of healthcare costs, the average American finds themselves navigating a complex landscape when it comes to paying for health insurance. Like a skilled artisan, this article seeks to unravel the mysteries of average health insurance costs, shedding light on the factors that influence premiums, deductibles, and out-of-pocket expenses. Through an analytical and informed lens, we aim to provide a comprehensive understanding of the financial burdens faced by the average American in their pursuit of healthcare coverage.

Key Takeaways

- Average health insurance costs for individuals range from $200 to $600 per month, while for families it ranges from $500 to $1,500 per month.

- HMO plans have the lowest premiums but require specific network providers, while PPO plans offer more flexibility but have higher premiums. EPO plans are similar to HMO plans but don’t require specialist referrals. On average, HMO plans have the lowest rates, followed by EPO and then PPO plans.

- Factors such as age, location, and coverage options significantly impact health insurance rates. Older individuals tend to have higher premiums due to more health issues, and healthcare costs and access vary by region, affecting rates. More comprehensive coverage leads to higher premiums, and deductibles and copayments also impact rates.

- Employer-sponsored health insurance coverage is more affordable than private plans. The cost varies based on company size, industry, and region, with employers contributing about 82% of single coverage premiums. Employees should carefully review coverage and costs.

Average Health Insurance Cost by Tier

The average cost of health insurance varies by tier, with a quantifier determiner indicating the specific range of expenses. Health insurance plans are typically categorized into different tiers, such as bronze, silver, gold, and platinum. Each tier represents a different level of coverage and cost. Bronze plans generally have the lowest monthly premiums but higher out-of-pocket expenses, while platinum plans have higher premiums but lower out-of-pocket costs. The average cost of health insurance for an individual in the United States can range from around $200 to $600 per month, depending on the tier and the individual’s age, location, and other factors. For families, the average cost can be significantly higher, ranging from $500 to $1,500 per month. It is important to carefully consider the coverage and cost of different tiers when choosing a health insurance plan.

Average Health Insurance Rates by Plan Type

Average health insurance rates can vary significantly based on the type of plan an individual or family chooses. The most common types of health insurance plans in the United States are Health Maintenance Organization (HMO) plans, Preferred Provider Organization (PPO) plans, and Exclusive Provider Organization (EPO) plans. HMO plans typically have the lowest premiums but require individuals to choose healthcare providers within a specific network. PPO plans offer more flexibility in choosing healthcare providers but usually have higher premiums. EPO plans are similar to HMO plans but do not require a referral to see a specialist. On average, HMO plans have the lowest rates, followed by EPO plans, and then PPO plans. Understanding the differences in plan types can help individuals and families make informed decisions about their health insurance coverage. Moving forward, let’s explore the cost of private health insurance.

Cost of Private Health Insurance

Private health insurance costs can vary significantly depending on various factors such as age, location, and coverage options. Understanding the cost of private health insurance is crucial for individuals and families who are looking to purchase coverage. Here are some key points to consider:

- Age: Younger individuals typically pay lower premiums compared to older individuals due to the lower likelihood of health issues.

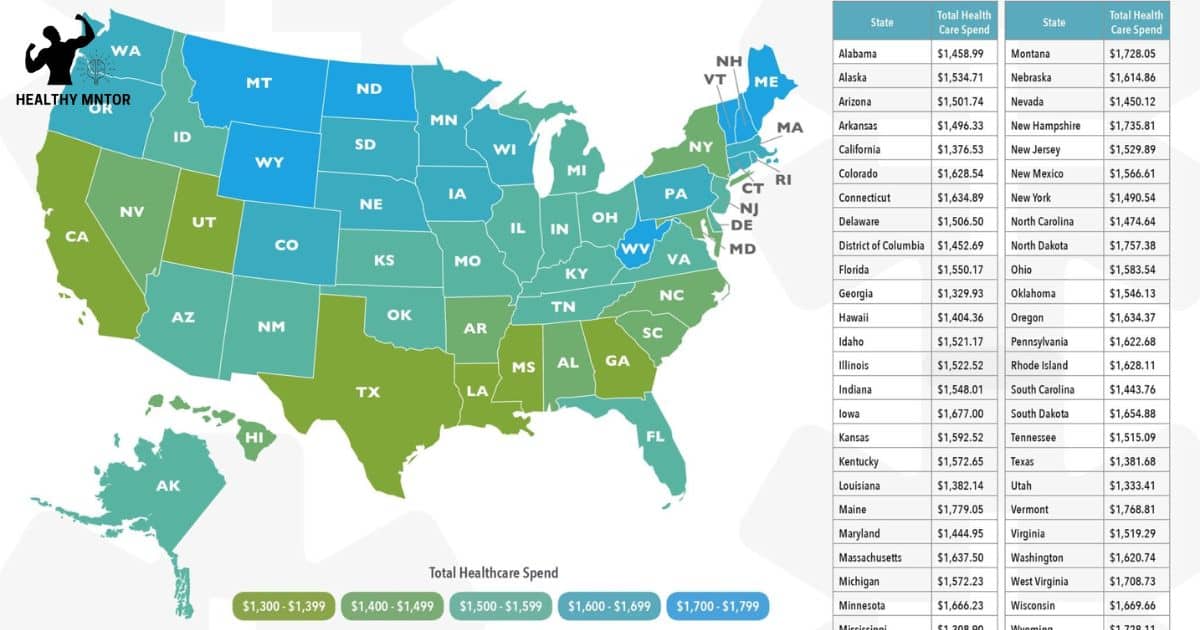

- Location: The cost of private health insurance can vary based on the state or region you live in. Factors such as local healthcare costs and competition among insurers can impact prices.

- Coverage options: The level of coverage you choose, such as a basic plan or a comprehensive plan, will affect the cost. Additional options like dental or vision coverage can also increase premiums.

It is essential to carefully evaluate these factors when selecting private health insurance to ensure that you find the most suitable and affordable coverage for your needs.

Factors Impacting Health Insurance Rates

Factors such as age, location, and coverage options significantly impact health insurance rates. These factors play a crucial role in determining how much individuals pay for their health insurance coverage. Age is an important consideration because older individuals tend to have more health issues and may require more medical care, resulting in higher insurance premiums. Location also plays a role, as healthcare costs and access can vary greatly depending on the region. For example, individuals living in urban areas may have access to more healthcare providers and facilities, which could lead to higher insurance rates. Additionally, coverage options, such as deductibles, copayments, and the extent of coverage, can impact insurance rates. Individuals with more comprehensive coverage will generally pay higher premiums compared to those with limited coverage options. These factors highlight the complexity of health insurance rates and the importance of considering various factors when choosing a health insurance plan.

Methodology of Determining Insurance Costs

Determining insurance costs involves a careful evaluation of various factors impacting health insurance rates, such as age, location, and coverage options. Insurance providers use a methodology that takes into account these factors to calculate the premiums individuals need to pay. Here’s a breakdown of the process:

- Age: Younger individuals generally pay lower premiums as they are considered to be healthier and at lower risk of developing health conditions requiring expensive treatments.

- Location: Insurance rates can vary based on the location of the insured. Factors like the cost of living and healthcare services in a particular area can influence the premium amounts.

- Coverage options: The extent and type of coverage selected by the individual also impact the insurance costs. More comprehensive plans with lower deductibles and a wider network of healthcare providers usually come with higher premiums.

Employer-Sponsored Health Insurance Costs

The average American pays a significant portion of their health insurance costs through employer-sponsored coverage. Employer-sponsored health insurance is a common benefit provided by companies to attract and retain employees. This type of coverage is typically more affordable than individual or family plans purchased on the private market. However, the cost of employer-sponsored health insurance can vary depending on factors such as the size of the company, the industry, and the region. Employers often negotiate contracts with insurance companies to provide coverage for their employees, and the cost is shared between the employer and the employee. On average, employers contribute about 82% of the premium for single coverage and 71% for family coverage. Employees are responsible for the remaining percentage, which is deducted from their paycheck. It is important for employees to carefully review the coverage and costs associated with their employer-sponsored health insurance to make informed decisions about their healthcare.

Individual Health Insurance Premiums on the Exchanges

On the exchanges, individuals, including people in the US who don’t have health insurance, pay varying premiums for their health insurance coverage. The cost of individual health insurance premiums on the exchanges can be influenced by several factors, including age, location, and plan choice. Here are some key points to consider.

- Age: Younger individuals generally pay lower premiums compared to older adults. This is because younger adults typically have fewer health issues and require less medical care.

- Location: Premiums can also vary based on where an individual lives. Areas with higher healthcare costs may have higher premiums.

- Plan Choice: Different plans offer varying levels of coverage and benefits. Premiums can differ based on the specific plan chosen, such as a bronze, silver, gold, or platinum plan.

Understanding these factors can help individuals make informed decisions when selecting a health insurance plan on the exchanges.

Health Insurance Deductibles and Out-Of-Pocket Costs

Health insurance deductibles and out-of-pocket costs can have a significant impact on an individual’s healthcare expenses. These costs refer to the amount that individuals are responsible for paying before their insurance coverage begins, and the additional expenses they incur during the course of their healthcare. Deductibles can vary widely depending on the type of health insurance plan, with higher deductibles generally resulting in lower monthly premiums. Out-of-pocket costs, on the other hand, include copayments, coinsurance, and any expenses not covered by insurance. These costs can add up quickly, especially for individuals with chronic conditions or those requiring frequent medical care. It is important for individuals to carefully consider these costs when choosing a health insurance plan, as they can greatly impact their overall healthcare expenses and financial well-being.

Frequently Asked Questions

Are There Any Government Programs Available to Help Lower-Income Individuals and Families Pay for Health Insurance?

Yes, there are government programs available to help lower-income individuals and families pay for health insurance. These programs include Medicaid, the Children’s Health Insurance Program (CHIP), and subsidies provided through the Affordable Care Act (ACA).

What Are Some Common Factors That Can Cause Health Insurance Rates to Increase?

Factors that can cause health insurance rates to increase include rising medical costs, increased utilization of healthcare services, changes in government regulations, and the aging population. These factors contribute to the overall cost of healthcare and subsequently impact insurance premiums.

How Do Health Insurance Rates Differ for Individuals Versus Families?

Health insurance rates can vary significantly based on whether coverage is for an individual or a family. Factors such as age, pre-existing conditions, and the number of individuals covered can contribute to the differences in rates between individuals and families.

What Are Some Alternative Options for Obtaining Health Insurance Coverage Outside of Employer-Sponsored Plans or the Exchanges?

Some alternative options for obtaining health insurance coverage outside of employer-sponsored plans or the exchanges include private health insurance plans, Medicaid, Medicare, and purchasing coverage directly from insurance companies. These options provide individuals with additional choices for securing their healthcare needs.

Are There Any Specific Demographic Groups That Tend to Pay Higher or Lower Health Insurance Premiums on Average?

Certain demographic groups may pay higher or lower health insurance premiums on average. Factors such as age, gender, location, and pre-existing conditions can influence premium rates. Analyzing these demographic patterns can provide insights into the cost variations within the health insurance market.

Conclusion

In conclusion, the cost of health insurance in the United States is exorbitant, leaving the average American burdened with high premiums, deductibles, and out-of-pocket expenses. The complex factors influencing insurance rates and the methodology used to determine costs only add to the frustration and stress experienced by individuals trying to afford adequate coverage. This dire situation calls for immediate attention and reform to ensure that every American can access affordable and quality healthcare without sacrificing their financial stability.